Weekly Brief for June 25, 2024

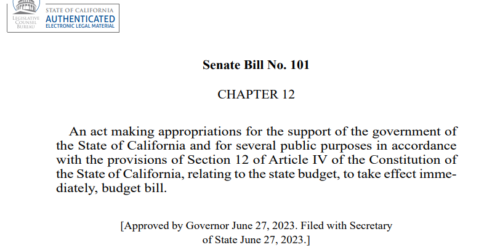

2024 Budget Update: Major Cuts to Government and Slight Tax Increase for Super-Wealthy Businesses.

The Governor announced this week a “budget deal” for a final version of this year’s state budget act to go into effect on July 1.

As the Governor proposed in May, the deal includes tax increases by two methods that target extremely wealthy businesses:

- Limits certain business tax credits to $5 million.

- Businesses that qualify for more than $5 million in certain government subsidies will be limited to just receiving at most $5 million for each of tax years 2025, 2026, and 2027.

- Pauses Net Operating Loss deductions for super-wealthy businesses.

- Businesses with $1 million or more in profit would not be allowed to use a net operating loss carried forward from a previous year until after 2028.

However, these tax increases will only provide about $17 billion over the next five years, with only $1 billion in revenue in the current tax year, and are set to sunset if tax revenues beat projections. The remaining $45 billion a year deficit will be filled by cuts to government spending and social programs.

Governor Delivers State of the State Address

The Governor delivered a tape-recorded address on Tuesday giving his report on the state of the state to the Legislature and to the public. Originally scheduled for March, this speech was delayed until now. The speech is available to watch at https://www.youtube.com/watch?v=0xN-kDXdnno.

Attorney General Releases State of Pride Report

The Attorney General released an 18-page report last week highlighting the California Department of Justice’s (DOJ) recent actions to support, uplift, and defend the rights of LGBTQ+ communities in California and nationally. The report is available for download from https://oag.ca.gov/system/files/attachments/press-docs/Pride%20Report%202024.pdf.